Facts About Feie Calculator Uncovered

Table of ContentsWhat Does Feie Calculator Do?See This Report on Feie CalculatorExamine This Report about Feie CalculatorEverything about Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.

He marketed his United state home to develop his intent to live abroad completely and applied for a Mexican residency visa with his other half to aid accomplish the Bona Fide Residency Examination. Additionally, Neil safeguarded a long-lasting residential property lease in Mexico, with strategies to ultimately buy a property. "I currently have a six-month lease on a residence in Mexico that I can expand another six months, with the intention to acquire a home down there." Neil aims out that getting home abroad can be challenging without first experiencing the location."We'll definitely be beyond that. Also if we come back to the US for medical professional's visits or business phone calls, I doubt we'll spend greater than one month in the United States in any type of given 12-month period." Neil stresses the significance of strict monitoring of U.S. gos to (Foreign Earned Income Exclusion). "It's something that people require to be really persistent concerning," he says, and suggests expats to be careful of typical blunders, such as overstaying in the U.S.

Rumored Buzz on Feie Calculator

tax responsibilities. "The factor why U.S. taxation on worldwide income is such a huge bargain is due to the fact that many individuals forget they're still based on united state tax obligation also after transferring." The U.S. is one of the few countries that taxes its residents no matter where they live, indicating that also if an expat has no income from united state

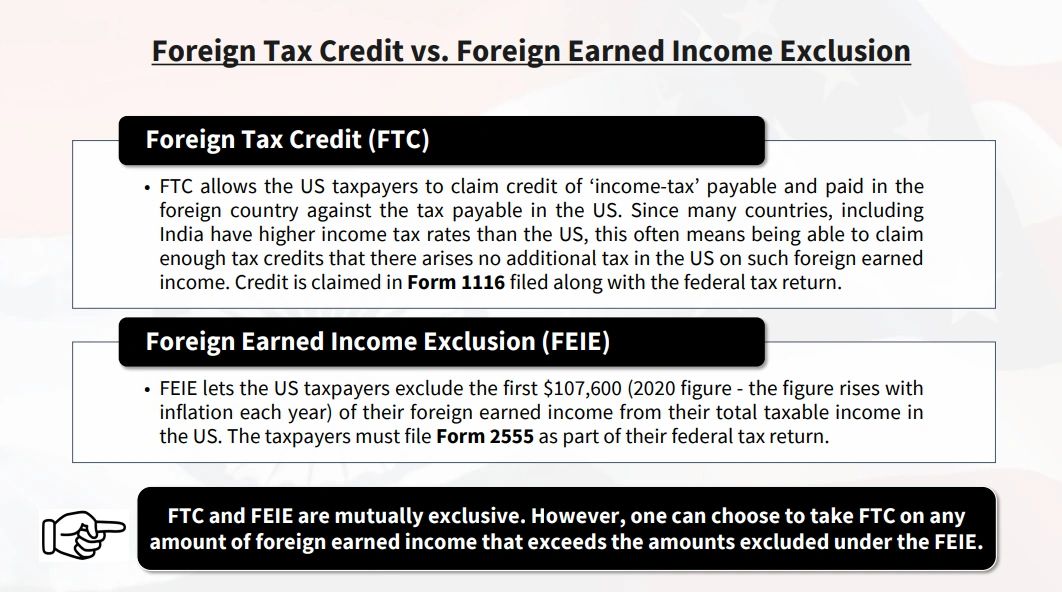

income tax return. "The Foreign Tax Credit allows people working in high-tax nations like the UK to counter their U.S. tax obligation by the amount they have actually currently paid in taxes abroad," states Lewis. This makes sure that expats are not exhausted two times on the exact same earnings. Nonetheless, those in low- or no-tax nations, such as the UAE or Singapore, face extra difficulties.

Feie Calculator - Truths

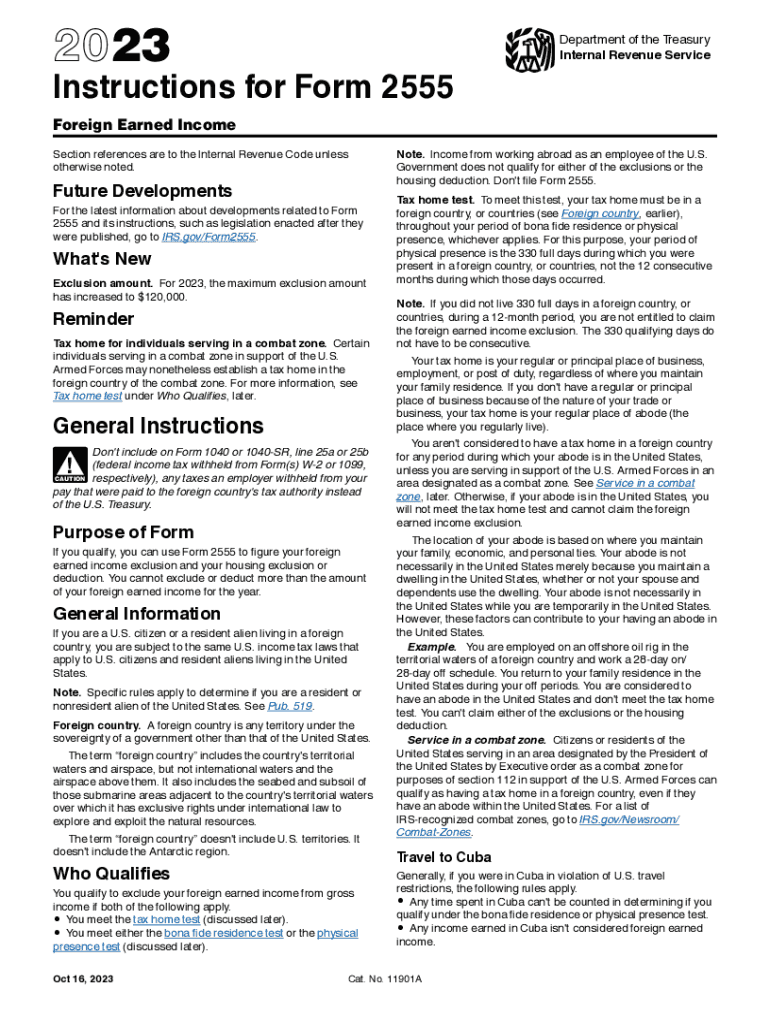

Below are some of the most often asked inquiries concerning the FEIE and other exclusions The Foreign Earned Earnings Exemption (FEIE) permits united state taxpayers to exclude up to $130,000 of foreign-earned earnings from federal earnings tax, reducing their united state tax obligation responsibility. To get FEIE, you must meet either the Physical Visibility Test (330 days abroad) or the Authentic House Examination (confirm your main house in an international nation here are the findings for a whole tax year).

The Physical Visibility Examination additionally needs United state taxpayers to have both a foreign income and an international tax home.

Some Known Facts About Feie Calculator.

An earnings tax treaty between the U.S. and an additional country can help prevent dual taxation. While the Foreign Earned Revenue Exemption decreases gross income, a treaty might supply extra benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a required filing for U.S. people with over $10,000 in international financial accounts.

Qualification for FEIE depends on meeting details residency or physical visibility tests. He has over thirty years of experience and now specializes in CFO solutions, equity compensation, copyright taxation, cannabis taxation and divorce associated tax/financial planning matters. He is an expat based in Mexico.

The international earned revenue exclusions, in some cases referred to as the Sec. 911 exemptions, exclude tax on wages made from functioning abroad.

Feie Calculator Fundamentals Explained

The tax benefit omits the revenue from tax obligation at lower tax obligation prices. Previously, the exclusions "came off the top" decreasing income subject to tax at the leading tax rates.

These exclusions do not exempt the wages from US taxation however simply supply a tax reduction. Note that a bachelor working abroad for all of 2025 who gained concerning $145,000 without various other income will have gross income lowered to absolutely no - properly the very same solution as being "tax obligation complimentary." The exclusions are computed every day.